Our Lindero Mine is in Salta, Argentina. The open-pit mine is operated by Mansfield Minera S.A., an Argentinian subsidiary 100% owned by Fortuna.

Fortuna acquired the fully permitted, shovel-ready development-stage project in July 2016. Over the following year, we optimized the Feasibility Study and made a positive construction decision in September 2017. Mass earth moving activities began in 2018, and the mine's first gold pour occurred on October 20, 2020. In 2023, the mine produced 101,238 ounces of gold.

The deposit is a gold porphyry, and based on December 31, 2023 reserves, Lindero has a pit life of 11 years.

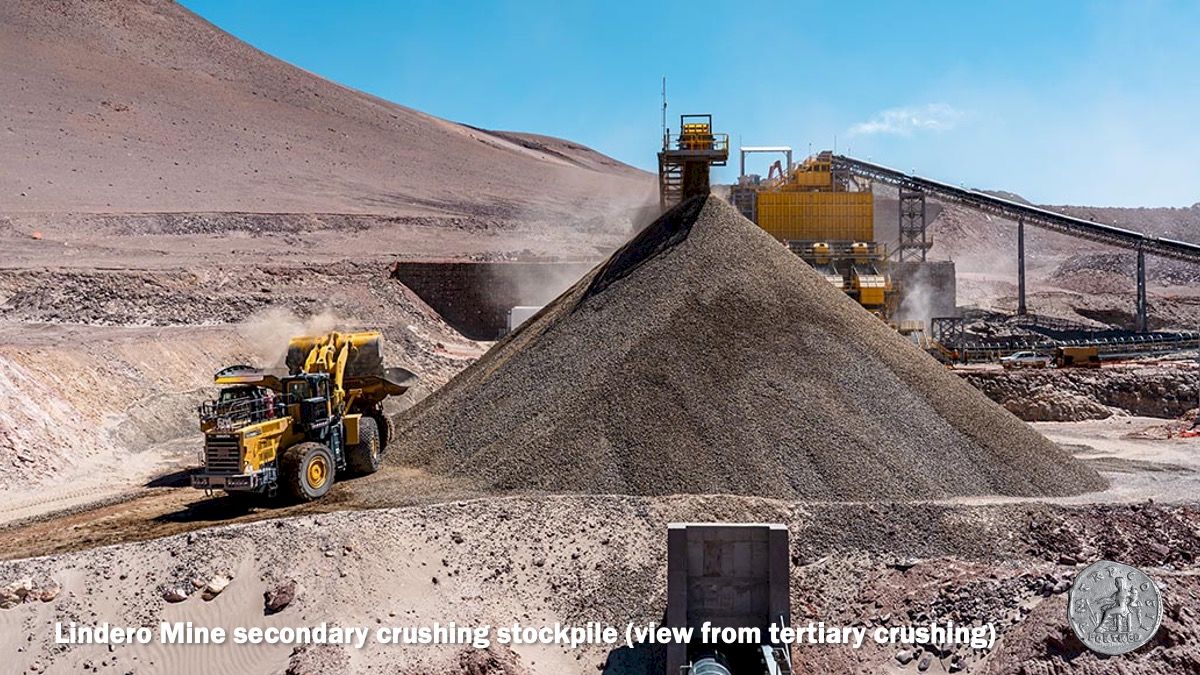

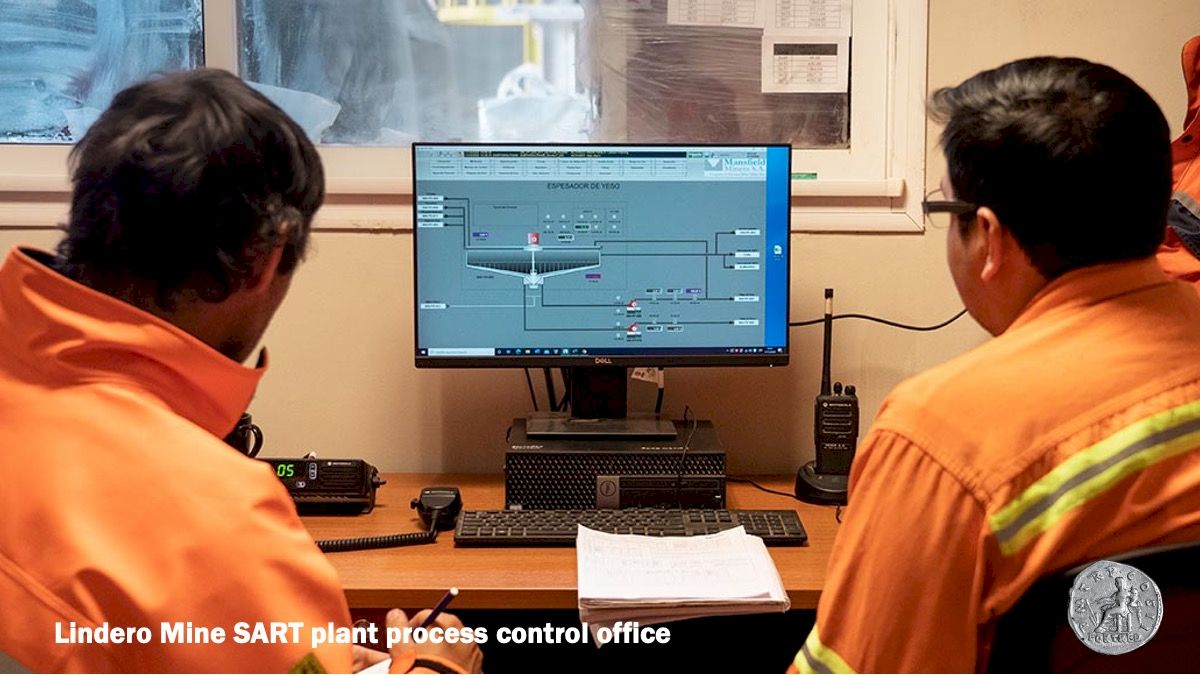

Crushing circuit at Lindero is designed to crush 18,750 tonnes of ore per day. The crushed ore is placed on a leach pad with the resulting pregnant solution pumped to SART (Sulphidisation, Acidification, Recycling and Thickening) and ADR (Adsorption – Desorption – Regeneration) plants before electrowinning and refining, where gold is poured as doré bars.

We recognize the role the Lindero Mine plays in the sustainable development in the Tolar Grande region. In 2022, we employed 175 community members and partnered with 12 suppliers from the local communities.

Lindero Mine Video

system

OPERATING HIGHLIGHTS

|

20231 |

2024E1 |

|

|---|---|---|

|

Ore placed on pad (Mt) |

6.0 |

6.6 |

|

Gold production (koz) |

101.2 |

93 - 105 |

|

AISC2,3,4 (US$/oz Au) |

$1,565 |

$1,730 - $1,950 |

Notes:

- Refer to Fortuna news releases dated January 18, 2023, "Fortuna reports record 2023 production of 452 koz Au Eq and 2024 annual guidance of 457 to 497 koz Au Eq"

- Cash Cost and all-in sustaining cost (AISC) are non-IFRS financial measures which are not standardized financial measures under the financial reporting framework used to prepare the financial statements of the Company and might not be comparable to similar financial measures disclosed by other issuers. Refer to the note under “Non-IFRS Financial Measures” on this website.

- The following table provides the historical cash costs and historical AISC for the four operating mines for the year ended December 31, 2022, as follows:

Mine Cash Costa,b,c AISCa,b,c SILVER ($/oz AgEq) ($/oz AgEq) San Jose, Mexico 9.30 14.38 Caylloma, Peru 13.46 18.94 GOLD ($/oz Au) ($/oz Au) Lindero, Argentina 617 1,116 Yaramoko, Burkina Faso 739 1,317 - (a) Cash cost and AISC are non-IFRS financial measures; refer to the note under “Non-IFRS Financial Measures” on this website.

- (b) Silver equivalent was calculated at metal prices of $1,802/oz Au, $21.75/oz Ag, $2,161/t Pb and $3,468/t Zn for the year ended December 31, 2022

- (c) Further details on the cash costs and AISC for the year ended December 31, 2022 are disclosed on pages 38, 40, and 41 (with respect to cash costs) and pages 39 and 42 (with respect to AISC) of the Company’s management discussion and analysis (“MD&A”) for the year ended December 31, 2022 dated as of March 15, 2023 (“2022 MD&A”) which is available under Fortuna's SEDAR+ profile at www.sedarplus.ca and is incorporated by reference into this news release, and the note under “Non-IFRS Financial Measures” on this website.

- Cash cost includes production cash cost and for Lindero, is net of copper by-product credit. AISC includes sustaining capital expenditures, worker’s participation (as applicable) commercial and government royalties mining tax, export duties (as applicable), subsidiary G&A and Brownfields exploration and is estimated at metal prices of $1,800/oz Au, $22/oz Ag, $2,000/t Pb, and $2,500/t Zn. AISC excludes government mining royalty recognized as income tax within the scope of IAS-12.

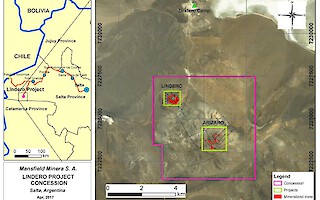

LOCATION

|

Our Lindero Mine is in the cold and dry Argentine Puna (plateau) at an altitude of approximately 3,500 to 4,000 meters above sea level (Latitude: 25° 04' 56" S, Longitude: 67° 46' 47" W). Mining occurs year-round. The mine is connected by road and railway to primary population centers. The regional capital, Salta, is 260 kilometres to the west and the closest town is Tolar Grande, approximately 75 kilometres from the mine. Access to the mine is via National Route 51, which passes through the towns of San Antonio de Los Cobres and Olacapato, and by Provincial Route 27, which passes through the towns of Pocitos and Tolar Grande. Most of the Tolar Grande community are members of the traditional Kolla nation. |

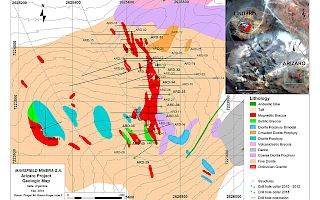

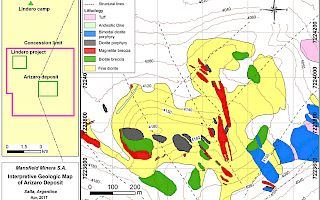

GEOLOGY AND MINERALIZATION

The Lindero deposit is a gold porphyry system hosted within a series of diorite to monzonite porphyritic stocks that intrude coarse-grained Ordovician granites and Early Tertiary red bed sandstones. Mineralization forms an inward plunging semi-circular shape approximately 600 meters in diameter and extends to a drill-tested depth of 600 meters. Gold-copper mineralization shows a strong relationship to lithology, potassium-feldspar alteration, and stockwork veining.

MINERAL RESERVES

79.2 million tonnes

averaging 0.57 g/t Au containing 1.44 Moz Au

Refer to Mineral Reserves and Resources table below for full disclosure

BROWNFIELDS EXPLORATION

The Brownfields exploration program for 2023 at the Lindero Mine of $0.3 million will be focused on reviewing the Arizaro project, located 3.5 kilometers to the southeast of the mine. Exploration at Lindero will also extend to regional prospect evaluation and portfolio reviews.

Technical Report

Mineral Reserves and Resources

|

Mineral Reserves - Proven and Probable |

Contained Metal |

||||

|---|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Cu (%) |

Au (koz) |

|

Lindero, Argentina |

Proven |

24,295 |

0.60 |

0.08 |

468 |

|

Probable |

47,210 |

0.54 |

0.11 |

816 | |

|

Proven + Probable |

71,505 |

0.56 |

0.10 |

1,284 |

|

|

Mineral Resources - Measured and Indicated |

Contained Metal |

||||

|---|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Cu (%) |

Au (koz) |

|

Lindero, Argentina |

Measured |

1,981 |

0.48 | 0.11 |

30 |

|

Indicated |

28,482 |

0.42 |

0.10 |

382 | |

|

Measured + Indicated |

30,464 |

0.42 |

0.10 |

412 |

|

|

Mineral Resources - Inferred |

Contained Metal |

||||

|---|---|---|---|---|---|

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Cu (%) |

Au (koz) |

|

Lindero, Argentina |

Inferred |

25,325 |

0.47 |

0.11 |

386 |

| Arizaro, Argentina | Inferred | 24,131 | 0.40 | 0.15 | 310 |

-

Notes:

- Mineral Reserves and Mineral Resources are as defined by the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of Mineral Reserves

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- Factors that could materially affect the reported Mineral Resources or Mineral Reserves include; changes in metal price and exchange rate assumptions; changes in local interpretations of mineralization; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environmental and other regulatory permits, and maintain the social license to operate

- Mineral Resources and Reserves for the Lindero Mine are reported as of December 31, 2023

- Mineral Reserves for the Lindero Mine are reported based on open pit mining within a designed pit shell based on variable gold cut-off grades and gold recoveries by metallurgical type: Met type 1 cut-off 0.28 g/t Au, recovery 75.4 %; Met type 2 cut-off 0.27 g/t Au, recovery 78.2 %; Met type 3 cut-off 0.27 g/t Au, recovery 78.5 %; and Met type 4 cut-off 0.31 g/t Au, recovery 68.5 %. Mining recovery and mining dilution have been accounted for during block regularization to 10-meter x 10-meter x 8-meter size. The cut-off grades and pit designs are considered appropriate for long term gold prices of $1,600/oz, estimated base mining costs of $1.36 per tonne of material, total processing and G&A costs of $9.78 per tonne of ore, and refinery costs net of pay factor of $12.20 per ounce gold. Reported Proven Reserves include 8.3 Mt averaging 0.44 g/t Au of stockpiled material. Mineral Resources are reported within a conceptual pit shell above a 0.24 g/t Au cut-off grade based on the same parameters used for Mineral Reserves and a 15 % upside in metal prices. Mineral Resources for Arizaro are reported within a conceptual pit shell above a 0.26 g/t Au cut-off grade using the same gold price and costs as Lindero with an additional $0.52 per tonne of ore to account for haulage costs between the deposit and plant. A slope angle of 47° was used for defining the pit

- Eric Chapman is the Qualified Person responsible for Mineral Resources and Raul Espinoza is the Qualified Person responsible for Mineral Reserves both being an employee of Fortuna Silver Mines Inc.

- Totals may not add due to rounding procedures

Photo Gallery

Corporate Video - A global intermediate gold and silver producer